Overview : Efficient and reliable ITR filing service in Rohini, Delhi. Our expert team ensures accurate tax return preparation and submission, providing personalized support to meet your financial needs. Contact us today for hassle-free tax filing solutions.

Filing Service In Rohini Delhi.png)

- Jul-29-2024

- by admin

- Income Tax

Professional ( ITR ) Filing Service In Rohini Delhi

Looking for professional ITR filing services in Rohini, Delhi? Our expert team offers comprehensive solutions to ensure your income tax returns are filed accurately and efficiently. We specialize in providing personalized assistance to navigate the complexities of tax regulations, helping you maximize your deductions and minimize your tax liability. Trust us to handle your financial documents with care and precision, ensuring compliance with all relevant tax laws. Experience stress-free ITR filing with our dedicated services in Rohini, Delhi.

Brief explanation of Income Tax Return (ITR) filing.

Filing an Income Tax Return (ITR) is the process through which taxpayers report their income, expenses, and taxes paid to the government. It is a way to ensure that individuals and businesses are compliant with tax laws and regulations. Filing an ITR involves providing details about your income from various sources, such as salary, business profits, or investments, and claiming deductions and exemptions available under tax laws. The information is used by tax authorities to calculate the tax liability and ensure that the correct amount of tax is paid. Timely and accurate filing helps avoid penalties and ensures that any excess tax paid can be refunded.

Benefits of using professional services over DIY filing.

Certainly! Here's a comparison of using professional services versus DIY filing, excluding the benefits of professional services:

DIY Filing:

-

Cost-Effective: You save money on professional fees, which can be significant.

-

Control: You have full control over the filing process and can ensure that every detail is to your liking.

-

Flexibility: You can work on the filing at your own pace and schedule.

-

Learning Opportunity: You gain knowledge and experience about the filing process, which can be beneficial for future reference.

Professional Services:

-

Expertise: Professionals bring specialized knowledge and experience to handle complex filing requirements.

-

Accuracy: With professionals, the chances of errors are minimized due to their thorough understanding of the process.

-

Time-Saving: Professionals can expedite the filing process, saving you valuable time.

-

Compliance: Professionals are familiar with current regulations and ensure that all requirements are met to avoid penalties.

Both approaches have their advantages and potential drawbacks, so the choice depends on your specific needs, budget, and comfort level with the filing process.

Personalized tax planning strategies.

Personalized tax planning strategies involve tailoring tax-saving approaches to fit an individual's unique financial situation and goals. Rather than using a one-size-fits-all method, personalized tax planning takes into account factors such as income level, investment portfolio, family status, and long-term financial objectives. This customized approach helps identify specific opportunities for deductions, credits, and other tax benefits that can maximize savings and minimize liabilities. By working with a tax professional to develop and implement a strategy that aligns with personal circumstances, individuals can achieve more effective tax management and better financial outcomes.

Centralized services for efficient processing.

Centralized services play a crucial role in enhancing efficiency by streamlining various processing tasks into a unified system. By consolidating services into a single point of control, organizations can manage and oversee processes more effectively, ensuring that operations are not only smoother but also more cost-effective. This approach minimizes redundancy, reduces the likelihood of errors, and accelerates decision-making, leading to improved overall performance and productivity.

Conclusion

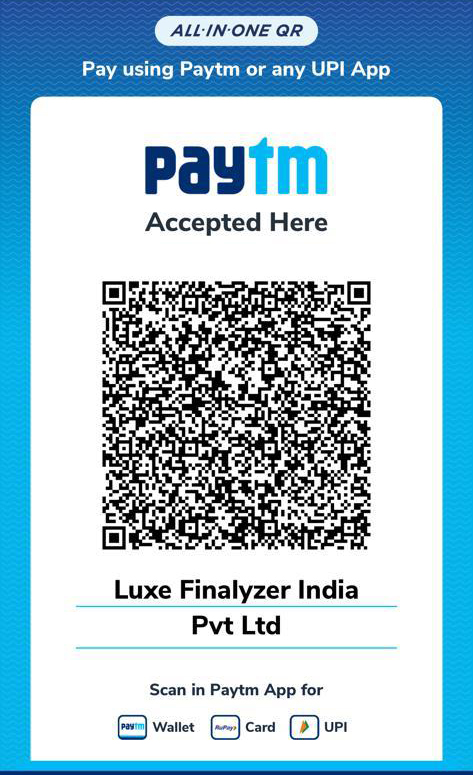

In conclusion, Luxe Finalyzer, a prominent taxation company based in Rohini, Delhi, stands out for its commitment to delivering comprehensive and accurate tax-related services. Their expertise in navigating complex taxation issues, combined with a deep understanding of local regulations and individual client needs, positions them as a valuable partner for anyone seeking reliable tax solutions. Whether you're an individual taxpayer or a business in need of specialized tax assistance, Luxe Finalyzer offers a blend of professionalism and personalized service that ensures clients receive the best possible outcomes. Their reputation for excellence and client-focused approach makes them a standout choice in the realm of taxation services.

.png)

Partner

Partner