Overview : Looking for expert ITR filing services in Panchsheel Park? Our experienced professionals ensure accurate and timely tax returns, helping you navigate complex tax regulations with ease. Get expert advice and efficient filing today!

- Jul-26-2024

- by admin

- Goods & Service Tax (GST)

Expert ITR Filling in Panchsheel Park

Expert ITR Filing in Panchsheel Park" provides specialized income tax return services, ensuring accurate and efficient filing for individuals and businesses. With extensive knowledge of tax laws and regulations, the service guarantees compliance and maximizes potential refunds, offering peace of mind to clients in Panchsheel Park.

Consequences of incorrect or delayed filing.

Incorrect or delayed filing can lead to penalties, interest charges, and legal complications. It may result in audits, damage to one's credit score, and potential loss of certain legal rights or claims. Businesses might face reputational damage, operational disruptions, and increased scrutiny from regulatory bodies. These consequences can create financial strain and administrative burdens, complicating future compliance efforts.

Choosing the correct form based on income sources.

Choosing the correct tax form depends on your sources of income. If you earn wages or salary, use a standard form like the 1040. For self-employed individuals, freelancers, or business owners, forms like the 1040 Schedule C or 1099 might be necessary. Investment income requires forms such as Schedule D. Each type of income has a specific form, ensuring accurate reporting and compliance with tax regulations.

Understanding deductions, exemptions, and rebates.

Deductions, exemptions, and rebates are key concepts in taxation that help reduce your taxable income, thereby lowering your tax liability. Deductions are specific expenses that you can subtract from your total income, such as mortgage interest or charitable donations. Exemptions are portions of income that are not subject to tax, often based on the taxpayer’s filing status or number of dependents. Rebates are partial refunds given by the government, often in response to taxes paid or as incentives for specific behaviors like energy efficiency improvements. Understanding these can help you maximize your tax savings.

Experience in handling various types of tax scenarios.

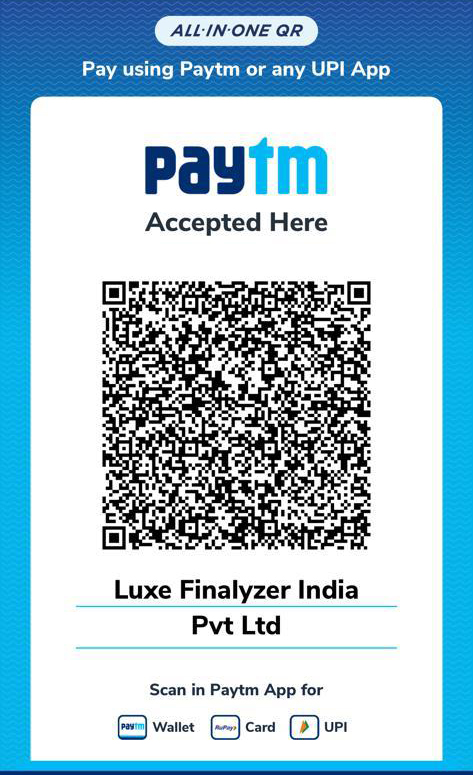

Luxe Finalyzer is a seasoned entity with extensive experience in managing a wide range of tax scenarios. Their expertise encompasses diverse tax situations, providing them with the capability to handle complex and varied tax-related challenges efficiently.

Conclusion

Luxe Finalyzer, a distinguished taxation company, stands out in the realm of financial services with its comprehensive approach to tax management. The company's expertise extends beyond basic tax filing jor bagh delhi to offer in-depth consultations and strategic planning, ensuring that clients receive tailored solutions that align with their unique financial circumstances. With a commitment to precision and a deep understanding of the ever-evolving tax landscape, Luxe Finalyzer not only helps individuals and businesses navigate complex tax regulations but also provides valuable insights that can lead to significant financial benefits. Their dedication to excellence and client satisfaction makes Luxe Finalyzer a trusted partner for anyone seeking reliable and effective tax solutions.

.png)

Partner

Partner