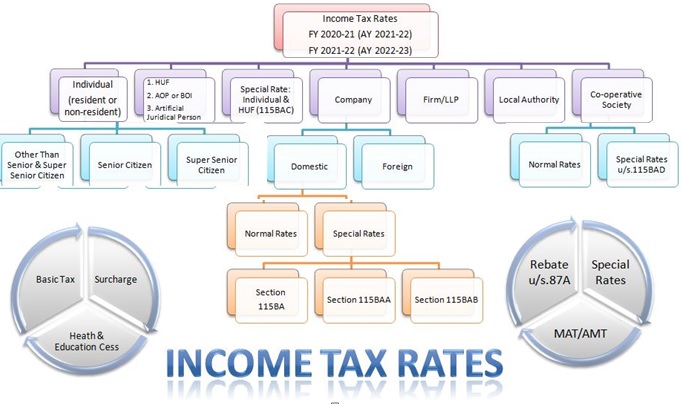

Overview : Income tax Slab rate for Private Company in india

Tax Slabs for Domestic Company for AY 2021-22

| Condition |

Income Tax Rate (excluding surcharge and cess) |

| Turnover or Gross Receipt in previous year 2018-19 not exceed ₹ 400 crores |

25% |

| If opted for Section 115BA |

25% |

| If opted for Section 115BAA |

22% |

| If opted for Section 115BAB |

15% |

| Any other Domestic Company |

30% |

Surcharge, Marginal Relief and Health & Education Cess

|

| What is Surcharge? |

|

Surcharge is an additional charge levied for persons earning income above the specified limits, it is charged on the amount of income tax calculated as per applicable rates

- 7% - Taxable income above ₹ 1 crore– Up to ₹ 10 crore

- 12% - Taxable income above ₹ 10 crore

- 10% - If Company opting for taxability u/s 115BAA or Section 115BAB

|

| What is Marginal Relief? |

| Marginal Relief is a relief from surcharge, provided in cases where the surcharge payable exceeds the additional income that makes the person liable for surcharge. The amount payable as surcharge shall not exceed the amount of income earned exceeding ₹ 1 crore and ₹ 10 crore respectively |

| What is Health and Education cess? |

| Health and Education cess @ 4% shall also be paid on the amount of income tax plus surcharge (if any). |

|

.svg) |

Note:

- A Company shall be liable to pay Minimum Alternate Tax (MAT) at 15% of book profit (plus surcharge and Health and Education cess as applicable) where the normal tax liability of the Company is less than 15% of book profit.

- A Company, being a unit of an International Financial Services Centre and deriving its income solely in convertible foreign exchange, MAT shall be payable at 9% (plus cess and surcharge as applicable)

- A Company opting for special rate taxation under Section 115BAA and 115BAB are exempt from paying MAT.

- The Companies opting for special rate of taxation u/s 115BAA or 115BAB will not be allowed certain deductions like section 80IA, 80IAB, 80IAC, 80IB and so on, except deduction u/s 80JJAA and 80M.

|

Investments/ Payments / Incomes on which I can get Tax Benefit

Tax deductions specified under Chapter VI-A of the Income Tax Act

| 80G |

|

Deduction towards donations made to certain funds, charitable institutions, etc.

Donation are eligible for deduction under the below categories:

| Subject to qualifying limit |

|

| 100% deduction |

| 50% deduction |

|

|

| Without any limit |

|

| 100% deduction |

| 50% deduction |

|

|

Note: No deduction shall be allowed under this section in respect of donation made in cash exceeding ₹ 2000/-.

|

| 80GGA |

|

Deduction towards donations made for Scientific Research or Rural Development.

Donation are eligible for deduction under the below categories:

Research Association or University, College or other Institution for

- Scientific Research

- Social Science or Statistical Research

|

Association or Institution for

- Rural Development

- Conservation of Natural Resources or for afforestation

|

| PSU or Local Authority or an association or institution approved by the National Committee for carrying out any eligible project |

Funds notified by Central Government for:

- Afforestation

- Rural Development

|

| National Urban Poverty Eradication Fund as set up and notified by Central Government |

Note: No deduction shall be allowed under this section in respect of donation made in cash exceeding ₹ 2000 or if gross total income includes income from Profit / Gains from Business / Profession.

|

| 80GGB |

| Sum contributed to Political Party or Electoral Trust is allowed as deduction (subject to certain conditions) |

|

Deduction of total amount paid through any mode other than cash |

|

| 80IA |

|

Undertaking engaged in Developing, Maintaining and Operating any Infrastructure Facility (only Indian Company), Industrial Parks (any Undertaking), any Power Undertaking, Reconstruction or Revival of Power Generating Plants (Indian Company) shall be entitled to claim deduction

(subject to certain conditions)

|

|

| 100% of profit for 10 consecutive AY falling within a period of 15 / 20 AY beginning with the AY in which Assessee develops / begins operating and maintaining infrastructure facility |

| (No deduction shall be allowed if development, operation, etc. started after specified dates for specified business) |

|

|

| 80IAB |

|

Deduction in respect of Profits and Gains by an Undertaking or an Enterprise engaged in development of Special Economic Zone

(subject to certain conditions)

|

|

| 100% of profit for 10 consecutive AY out of 15 AY beginning from the year in which a Special Economic Zone has been notified by the Central Government |

| No deduction to an Assessee, where the development of Special Economic Zone begins on or after 1st April 2017 |

|

|

| 80IAC |

| Profit and Gains derived by an Eligible Start-up from Specified Business |

|

100% of profit for 3 consecutive assessment years out of 10 years beginning from the year in which the eligible Start-up is incorporated |

|

| 80IB |

|

Deduction towards Profits and Gains from Specified Business

The deduction under this section is available to an Assessee whose gross total income includes any Profits and Gains derived from the business of:

| Industrial Undertaking including an SSI in J&K |

| Commercial Production and Refining of Mineral Oil |

| Processing, Preservation and Packaging of Fruits or Vegetables, Meat and Meat Products or Poultry or Marine or Dairy Products; Integrated Business of Handling, Storage and Transportation of Food Grains |

| (Subject to certain conditions) |

100% / 25% of profit for 5 / 10 / 7 years as per conditions specified for different types of undertakings

|

| 80IBA |

| Profit and Gains derived from Developing and Building Housing Projects |

|

100% of profit subject to various conditions specified |

|

| 80IC |

|

Deduction in respect of certain Undertakings in Himachal Pradesh, Sikkim, Uttaranchal and North-Eastern states

(subject to certain conditions)

|

|

100% of profits for first 5 AY and 25% (30% for a company) for next 5 AY to manufacture or produce specified article or thing |

|

| 80IE |

|

Deduction to certain Undertakings set up in North-Eastern states

(subject to certain conditions)

|

|

100% of profits for 10 AY subject to various conditions specified |

|

| 80JJA |

|

Deduction in respect of Profits and Gains from Business of Collecting and Processing of Biodegradable Waste

(subject to certain conditions)

|

|

100% of profits for 5 AY where the gross total income of an Assessee includes any Profits and Gains derived from the Business of Collecting and Processing or treating of Biodegradable Waste |

|

| 80JJAA |

|

Deduction in respect of Employment of New Workers / Employees, applicable to Assessee to whom Section 44AB applies

(subject to certain conditions)

|

|

30% of additional employee cost for 3 AY, subject to certain conditions |

|

| 80LA |

|

Deduction for Income of Offshore Banking Units and International Financial Services Centre

(subject to certain conditions)

|

|

100% / 50% of specified income for 5 / 10 AY, as per specified conditions |

|

| 80M |

| Inter-corporate dividend shall be allowed to be reduced from Total Income of Company receiving the dividend if same is further distributed to shareholders |

|

Where the Gross Total Income of Domestic Company in any previous year includes any income by way of dividends from any other Domestic Company or Foreign Company ,there shall, in accordance with and subject to provisions of this section, be allowed in computing the Total Income of such Domestic Company, a deduction of an amount equal to so much of the amount of income by way of dividend received from such other Company as does not exceed the amount of dividend distributed to shareholder one month prior to the due date of filing of return |

|

| 80PA |

| Producer company engaged in an Eligible Business of Marketing, Purchase or Processing of Agricultural Produce of its Members |

|

100% of profits for a period of 5 years from the AY 2019-20 subject to the condition that the total turnover of Company shall be less than ₹ 100 crores during the FY |

|

.png)

Partner

Partner