Overview : Income Tax New Slab & Income Tax old Slab for AY 2021-22

- Jun-08-2021

- by admin

- Income Tax

Income tax Slabs for AY 2021-22

Tax Slabs for AY 2021-22

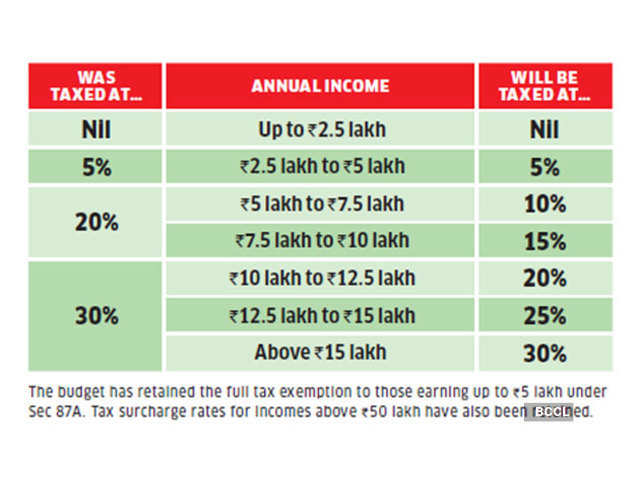

Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation (u/s 115 BAC of the Income Tax Act)

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions (like 80C, 80D,80TTB, HRA) available in the Existing Tax Regime.

|

For Individual (resident or non-resident) less than 60 years of age anytime during the previous year:

|

|||||||||||||||||||||||||||||||||||||

|

For Individual (resident or non-resident), 60 years or more but less than 80 years of age anytime during the previous year:

|

|||||||||||||||||||||||||||||||||||||

|

For Individual (resident or non-resident) 80 years of age or more anytime during the previous year:

|

|||||||||||||||||||||||||||||||||||||

|

Note: 1. The rates of Surcharge and Health & Education cess are same under both the tax regimes 2. Rebate u/s 87-A Resident Individual whose Total Income is not more than ₹ 5,00,000 is also eligible for a Rebate of 100% of income tax or ₹ 12,500, whichever is less. This Rebate is available in both tax regimes |

Surcharge, Marginal Relief and Health & Education Cess

|

.png)

Partner

Partner