Overview : Key Highlights/Decisions Taken of the GST Council Meeting held on 12.06.2020 for GST Late Fees & GST Revocation

- Jun-12-2020

- by admin

- Goods & Service Tax (GST)

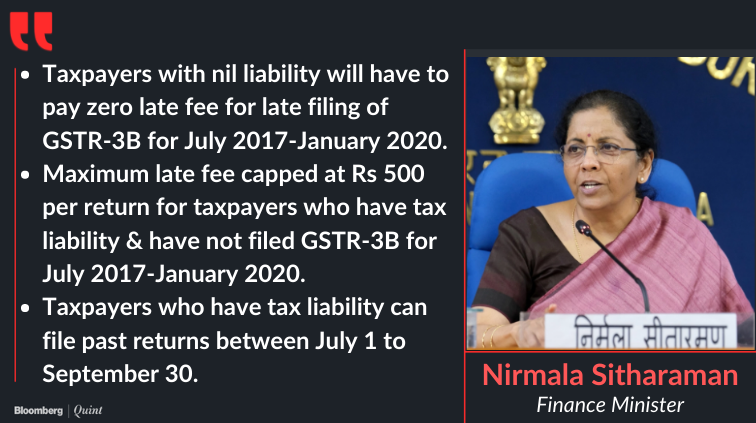

40th GST Council Meeting :-Late fee For GST Nil Return is Zero and For Having Tax Liability upto Rs 500 only for GSTR-3B from July 2017-Jan 2020

In 40th GST Council Meeting, the main focus of Hon’ble Finance Minister Smt. Nirmala Sitharaman was on this statement : “For the period from July 2017 to Jan 2020, which is prior to COVID-19 period, a lot of return filing has been pending.” The Goods and Services Tax Council on Friday decided to further ease compliance burden of businesses by providing relief on late free and interest payable on late payments.

It reduced late fee and interest for those with tax liabilities and waived off late fee completely for those with no tax liabilities.

In view of the above statement, the decisions taken by the Council Meeting are as under :

(1.) For all those who have no tax liabilities but have not filed their returns between July 2017 to Jan 2020, there will be Nil late fees.

(2.) For people who have tax liability, maximum late fee for non-filing of GSTR-3B returns for the period July 2017 to January 2020 has been capped to Rs 500. This will apply to all returns submitted during 1st July, 2017 to 30th September, 2020.

(3.) For small tax payers whose aggregate turnover is up to Rs. 5 crore, the rate of interest for late furnishing of GST returns for Feb, Mar and April 2020, beyond July 6, 2020 : The rate of interest is being reduced from 18% to 9% per annum and that is only till 30th September, 2020.

(4.) Small tax payers whose aggregate turnover is up to Rs 5 crore will be provided a waiver of late fees and interest if they file the form GSTR-3B for the supplies affected in months of May, June and July 2020, by September 2020 (Staggered dates to be notified).

(5.) To facilitate the taxpayers who could not get their cancelled GST registration restored in time, an opportunity is being provided for filing of application for revocation of cancellation of registration up to 30th September, 2020, in all cases where registrations have been cancelled till 12.06.2020

To File your pending Gst Return Please Contact us @ 9990061912 or [email protected]

.png)

Partner

Partner